- home

- ACCOUNTING SERVICES

ACCOUNTING SERVICES

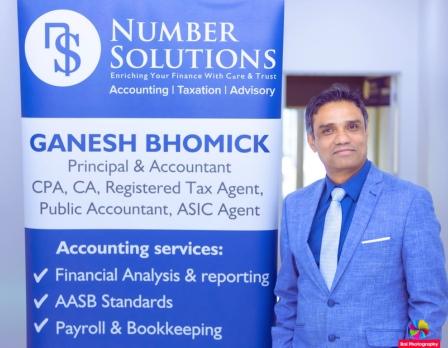

Welcome to Number Solutions, your premier destination for the full range of accounting services tailored to meet the unique needs of both individuals and businesses. With our expertise and commitment to excellence, we strive to provide exceptional financial solutions at every aspect of your personal or business life.

Number Solutions collaborates with business owners across various industries, providing essential support in managing their accounting, tax, and overall business planning needs. Discover how we can assist you for your accounting and bookkeeping services by contacting us at 02 9174 5327.

Accounting Services We Provide

- Payroll & Bookkeeping

- Financial Reports Preparation

- Transactional Accounting

- Financial Analysis

- Cash Flow Management

- Compilations and Financial Reviews

- Cloud-based Accounting Setup

- Cloud Accounting Training

- Business Succession Planning

- Accounting for Not-for-Profit Organisations

- NSW Real Estate Trust Account Audit

- NSW Solicitor Trust Account Audits

Why Is Accounting Important?

The importance of accounting in business is undeniable. Proper accounting practices are essential for keeping the trade on track and improving growth possibilities. It helps in ascertaining the financial health of the organisation. Accurate data regarding turnover and profit immensely aid the management in decision-making.

Accounting is part of each and every successful business accounting. Accounts cater to all trading; that is why a business cannot exist or be able to serve without the help of professional accountants. Accountants play a vital role in bookkeeping, auditing, tax preparation services, and consultancy among other roles. Almost all businesses need essential accounting and financial planning and services including tax accounting, tax returns, tax advice, bookkeeping, payroll, wealth management, consultancy and advisory, auditing, and assurance services.

Whether you require assistance with any accounting need, our dedicated team is here to ensure your financial success.

Trust Number Solutions handles your accounting matters with professionalism, accuracy, and utmost care.

Check this out: Taxation Services for All Types of Business

Why Is Important to Keep Financial Records

Your financial records reflect the results of operations and the financial position of your trade or corporation. In other words, they help you understand what’s going on with your business financially.

Not only will clean and up-to-date records help you keep track of expenses, gross margin, and possible debt, but it will help you compare your current data with the previous accounting records and allocate your budget appropriately.

The Importance of Budgeting in Business

Budgeting and future projections can make or break a company, and your financial records will play a crucial role when it comes to it.

Business trends and forecasts are based on historical financial data to keep your operations profitable. This financial data is most appropriate when provided by well-structured accounting processes.

Monitoring: The Key to Good Investor Relationship

Proper monitoring of expenditures and budget overheads are essential to maintain a healthy financial status. It will allow you to identify areas where you spend excessive money. Or the ROI is not as expected. Subsequently, you can reduce spending on those areas.

The money thus saved could be utilised for improvement in other fields. The timely publication of financial health data to the investors will enrich the business-investor relationship. This will lead to more people interested to invest in your company.

It will also increase the brand value and share prices. All this will result in the growth of your firm indirectly.

Accounting And Regulation Compliance

Businesses are required to file their financial statements with the regulatory board to meet the necessary obligations. Listed entities are required to file them with stock exchanges and for direct and indirect tax filing purposes. Accounting plays a critical role in all these scenarios. Proper accounting will help maintain statutory compliances when it comes to your business. Liabilities such as GST, income tax, pension funds and others will be properly addressed. Non-maintenance of books and accounts is an offence punishable by law. If a company fails to abide by the statutory compliances, the company will be liable for a huge penalty.

Law requires companies to maintain an accurate financial record of their transactions and share the reports with the shareholders, tax authorities and regulators. The financial statements and information are also required for indirect and direct tax filing purposes.

Check this out: Business Formation, Registration and Compliance

How Important Is Accounting For Small Business?

Poor financial management is one of the primary reasons for small business failure, especially in the first year of the business. Since small entrepreneurs have a limited budget and other resources, accounting plays a crucial role in providing information that helps businesses grow and develop.

Accounting helps small business accounting in numerous ways to achieve their personal and business goals. Keeping track of cash flow can prevent a small company from running dry. Implementing accounting policies according to your financial advisor to record finances efficiently helps to strategise the business immensely. Understanding concepts such as fixed costs, variable costs, and how to accurately cost a project is incredibly beneficial for small entrepreneurs.

Accounting gives you a better grasp of the well-being of the company and helps your business grow. You can do this by learning to read a balance sheet, income statement, and cash flow statement of your business life cycle.

Whether you are a solopreneur or employ staff, the key to growing your small company is to review your financial statements regularly and establish a detailed budget that will allow you to discover operational inefficiencies. Also, they can be helpful to take your financial decisions. Saving a little bit on several expenses can add up to significant results over the long run.

So if you are a small business owner, then our small business accountant and the adviser will guide you as per your accounting requirements to take important business decisions. We are committed to helping you make accounting simple to generate more revenue for your small company.

Check this out: Business Advisory Services

How Can Number Solutions Help for Your Accounting Needs?

Number Solutions is a professional agency specialising in the preparation of tax, bookkeeping, personal financial advice, business advisory, business activity statements (bas), asset management and all relevant accounting services. We believe in a custom-tailored service for each client, as the operation’s requirements, size, and budget are different for all companies. Working with small businesses is incredibly exciting as it is inspiring to watch companies succeed out of barely anything.

The experienced consultancy of our professionals will be beneficial for you to take the right strategic decisions for your company. If you want to improve your business’s accountability, productivity, and future strategies, Number Solutions can be your trusted ally in Liverpool, Bankstown, Campbelltown, Parramatta and across Western Sydney of NSW, Australia. Our consultants are ready to help you for all kinds of accounting and bookeeping service.

- Accounting Services

- Taxation Services

- Self-Managed Super Fund

- Business Formation, Registration and Compliance

- Business Advisory

Need Consultation

WHY CHOOSE US

With Number Solutions Tax & Accounting your business growth is guaranteed because value-centred solution helps you to grow your company to the highest levels of profitability.

- We create value and make a real difference to your business using our extensive industry knowledge and experience.

- We listen and work with your partnership to provide the most effective solutions for your business.

- We genuinely care about your business.

- We work with you to increase your profit at the affordable price.

- We maintain high-level constancy in our service so that you business is operating well.